#daytradechatter

Wed Aug 23 23:04:13 2023 (*6952cd93*):: Airbnb getting banned in NYC https://www.avalara.com/mylodgetax/en/blog/2023/06/new-york-city-delays-enforcement-of-new-str-law-to-september-following-lawsuit.html :clown_face: Leftists hate petite bourgeoisie more than the actual ruling class. +public! *** New York City delays enforcement of new STR law amid lawsuits *** New York City officials have delayed enforcement of the city’s new short-term rental (STR) ordinance until September 5. The move comes after Airbnb and three short-term rental hosts sued the city on June 1 over the new rules, calling them a “de facto ban against short-term rentals.” *** Avalara, Inc.

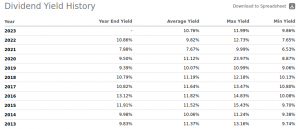

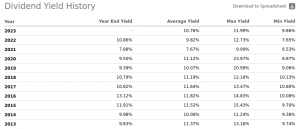

(*07ae591a*):: I am more of an investor than a trader, and certainly not a day trader, but I am pleased to share that a $9X,XXX position that I opened yesterday rose more than 1.6% today, with another >0.7% rise in after hours trading 😀 (*6952cd93*):: What did you buy? I can’t wait to get back in the game. Been forced on the sidelines this year. (*07ae591a*):: That position is in an atypical BDC. Beta of almost zero; strong, diversified income from senior debt held primarily by investment grade clients with a proven and established business model (many with some rent-seeking aspects; i.e. taxpayer funding) handsomely covering the yuuuuge dividend (picrel) with monthly distributions.

The share price of this BDC has actually dropped a bit since inception in 2010, but it’s also paid out more considerably more than the original share price over that time period, as you can tell from this historic yield chart.

The share price is somewhat volatile, but the dividend isn’t. It was switched from quarterly to monthly back at the end of 2012, lowered slightly (about 14%) at the end of 2016, has since (end of 2022) been raised to just 5% below it’s 2012-2016 level. Not a single missed payment in that time period. It’s not like it’s Realty Income-tier “ol reliable” , but instead of $O’s ridiculous P/AFFO, this guy’s actually severely undervalued right now by my metrics (despite being overvalued relative to NAV), so I’m keeping kinda quiet about it… but there’s enough hints here to figure it out if you’re really interested.

(*07ae591a*):: This is US equities, to be clear, not crypto. I am into crypto for the “fuck the federal reserve, fuck the surveillance dragnet, fuck the government” part, not the trying to get rich quick part. (*6952cd93*):: Nice. We trade everything here. (*6952cd93*):: has a stream he does regularly at tradingview, does some great analysis (*b36962f9*):: I first thought nvidia was your play until I read comments (*6952cd93*):: $NVDA is such a beast. It’s been cool to see it grow into this behemoth from the modest gpu shop to run hardware accelerated quake lol. I remember how awesome it was when I upgraded from dual SLI voodoo2 cards to the first geforce card (*6952cd93*):: the hackers that used shaders for non-graphics workloads changed the world (*07ae591a*):: I am more of an investor than a trader, and certainly not a day trader, but I am pleased to share that a $9X,XXX position that I opened yesterday rose more than 1.6% today, with another >0.7% rise in after hours trading 😀 (*6952cd93*):: What did you buy? I can’t wait to get back in the game. Been forced on the sidelines this year. (*07ae591a*):: That position is in an atypical BDC. Beta of almost zero; strong, diversified income from senior debt held primarily by investment grade clients with a proven and established business model (many with some rent-seeking aspects; i.e. taxpayer funding) handsomely covering the yuuuuge dividend (picrel) with monthly distributions.

The share price of this BDC has actually dropped a bit since inception in 2010, but it’s also paid out more considerably more than the original share price over that time period, as you can tell from this historic yield chart.

The share price is somewhat volatile, but the dividend isn’t. It was switched from quarterly to monthly back at the end of 2012, lowered slightly (about 14%) at the end of 2016, has since (end of 2022) been raised to just 5% below it’s 2012-2016 level. Not a single missed payment in that time period. It’s not like it’s Realty Income-tier “ol reliable” , but instead of $O’s ridiculous P/AFFO, this guy’s actually severely undervalued right now by my metrics (despite being overvalued relative to NAV), so I’m keeping kinda quiet about it… but there’s enough hints here to figure it out if you’re really interested.

(*07ae591a*):: This is US equities, to be clear, not crypto. I am into crypto for the “fuck the federal reserve, fuck the surveillance dragnet, fuck the government” part, not the trying to get rich quick part. (*6952cd93*):: Nice. We trade everything here. (*6952cd93*):: has a stream he does regularly at tradingview, does some great analysis (*b36962f9*):: I first thought nvidia was your play until I read comments

Leave a Reply

You must be logged in to post a comment.